In a VUCA world, businesses have to protect their brands in today’s volatile markets. If that feels too complex, let’s first unpack what we mean by a volatile market.

Simply put, a volatile market is a market where prices move at a rapid speed in an unpredictable way over short spans of time, not only inclining but declining too.

Why are volatile markets an issue for businesses?

Volatile markets actually force businesses to increase their prices in an economy where the consumer’s purchasing power is notably declining. This creates a paradox in today’s market, which is different from before. This dilemma puts Financial & Marketing Managers in a situation where they must face the risk of diminishing their market share behind the ratio of price increases.

So does this mean there’s no escape?

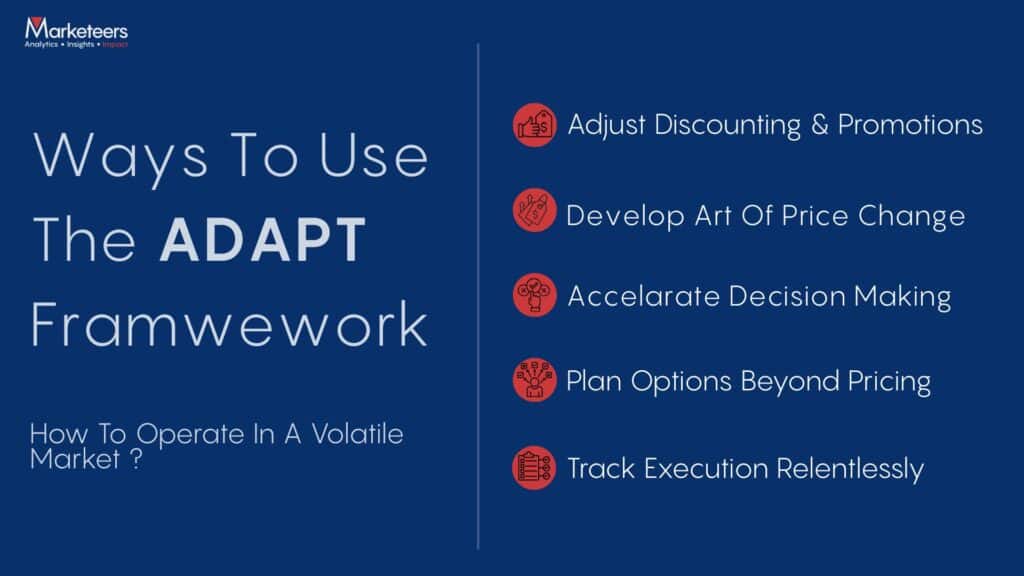

The good news is that despite these dire consequences, the “ADAPT” framework could support pricing decisions for both Financial & Marketing Managers. Hence, we will discuss this framework and how to apply it so that you actually create pricing decisions without significant losses in your market share.

In this blog, we will go through:

- What Are the Common Causes of Market Volatility

- What Are the Different Types of Volatility

- What Are the Risks of Market Volatility

- How to Use the ADAPT Framework to Support Pricing Decisions

What Are the Common Causes of a Volatile Market?

Market volatility is caused by many factors, including:

- Tariffs

- Tech Weakness

- Fear of Recession

- Interest Rates

So let’s discuss these causes one by one.

Tariffs

Tariff wars impact businesses in many ways. To note a few:

- Consumer surveys weakening

- Business surveys weakening

- Consumer sentiment continues to drop

In volatile markets, consumers are less likely to consume more, which leads businesses to avoid heavy investments in their operations. Though consumer consumption has been reduced notably through past years, it is worth mentioning that consumers are still capable based on their net worth and wage growth.

Broadly speaking, they are doing relatively well even with inflation.

That being said, even while there are short-term disruptions to certain industries, not all tariffs have to be implemented, and even those that can be cannot change business fundamentals. So if you have a business plan that you feel is the go-to, you better stick to it.

Tech Weakness

Due to the rise of agentic AI models around the world and many countries actively competing, tech weakness has been identified due to the introduction of AI models such as DeepSeek’s model. This rise, along with investors’ lessened willingness to take on more risky sectors, has consequently led the technology sector to be one of the worst-performing ones.

Even though the sector is weak as we speak, a lot of corporate financial gains are strong, including many technological firms too.

Given this, if you invested heavily in tech stocks, it is worth considering investing in diverse sectors too, so there’s less risk.

Fear of Recession

Due to fierce competition and the state of the market, fear of recession has circulated through many countries in the last few years, notably within the US.

That being said, it is important to note that there is no clear evidence that the US economy is actually on the way to recession.

If you are in the US and in a similar situation, it is beneficial to consider having enough diverse international clients. This is due to the fact that emerging and developing countries remain price-based on valuation measures.

Does this mean that there’s no risk in investing in foreign countries?

The truth is that even investing in international markets imposes risks that are unique to each market, so it is beneficial to understand every market before making an investment.

Interest Rates

Interest rates have skyrocketed, with many investors wishing that these rates decrease. Interest rates remaining relatively high has been a notable factor in volatile markets in the past few years.

This has led investors to want to see more progression made before moving in an aggressive way to lower rates. Many countries’ spending has reduced, which has led to fears circulating that this will hinder the growth of firms, increase rates of unemployment, and limit countries’ capacity to actually manage the economy effectively.

What Are the Different Types of Market Volatility?

There are plenty of types of market volatility that we can go through, but we choose to go into the most notable and influential ones instead.

So what are these types of volatility? Let’s discuss each one by one.

Understanding Types of Volatility

Volatility is a critical concept in financial markets, measuring the degree of price fluctuation in assets. Understanding the different types of volatility helps traders, investors, and analysts assess risk, predict market movements, and optimize portfolios.

| Type of Volatility | Definition & Key Characteristics |

|---|---|

| Implied Volatility |

In simple terms, implied volatility is the volatility that has been derived from option prices. To elaborate, it is the market’s expectation of future volatility, showing how much price movement is expected until expiration. It is an indication of whether prices will be higher (High IV) or whether prices will be stable (Low IV). So it is not a prediction of direction, but of magnitude. |

| Historical Volatility |

As the name indicates, this type of volatility measures price movements of an asset over a set time period. Historical volatility is a metric commonly used by traders and investors to assess the risks of an asset. If historical volatility is high, the security is a bit at risk, as this indicates prices increasing and decreasing. That being said, this type of volatility does not predict whether prices will go up or down. It is often used to identify the current sentiment or fear of the market. |

| Forecast Volatility |

This is the predicted volatility based on modeling. Forecasting volatility is actually a prediction tool for the magnitude of future fluctuations, risks that might turn into reality, and portfolio optimization. This forecast is used to mitigate risks in the sense that it is used to estimate future portfolio losses and assure capital adequacy during extreme conditions. Another way these forecasts are essential is in derivative pricing, where accurate volatility estimates are crucial for proper valuation. |

Implied Volatility

In simple terms, implied volatility is the volatility that has been derived from option prices. To elaborate, it is the market’s expectation of future volatility, showing how much price movement is expected until expiration.

It is an indication of whether prices will be higher (High IV) or whether prices will be stable (Low IV). So it is not a prediction of direction, but of magnitude.

Historical Volatility

As the name indicates, this type of volatility measures price movements of an asset over a set time period.

Historical volatility is a metric commonly used by traders and investors to assess the risks of an asset. If historical volatility is high, the security is a bit at risk, as this indicates prices increasing and decreasing.

That being said, this type of volatility does not predict whether prices will go up or down. It is often used to identify the current sentiment or fear of the market.

Forecast Volatility

This is the predicted volatility based on modeling. Forecasting volatility is actually a prediction tool for the magnitude of future fluctuations, risks that might turn into reality, and portfolio optimization.

This forecast is used to mitigate risks in the sense that it is used to estimate future portfolio losses and assure capital adequacy during extreme conditions.

Another way these forecasts are essential is in derivative pricing, where accurate volatility forecasts are vital for evaluating options, specifically mitigating risks of the options themselves.

How to Use the ADAPT Framework to Support Pricing Decisions

In these dire circumstances, the ADAPT framework can support your pricing decisions to navigate inflation.

1. Adjust Discounting and Promotions, and Maximize Non-Price Levers

By utilizing a holistic approach to assess where all your company’s expenses are going, you can then discover revenue opportunities in areas that aren’t directly related to the price of your products.

This way, you are absorbing the price increase via productivity, different discounts, surcharges, taxation, etc.

As an example, Company A can remove nonperforming SKUs from trade channels, and that would reduce costs and increase distribution efficiency.

Another method Company A can use is to increase the cost of extra services such as express delivery.

2. Develop the Art and Science of Price Change

By tailoring your prices for each target segment, you ensure customer value.

This is done by measuring how price-sensitive customers are to specific price points with data analytics and predictive models. By doing so, you can retain your sales margins by assessing the willingness to pay for specific SKUs from your brand.

3. Accelerate Decision-Making Tenfold

Because we are in inflationary times, we need price decisions that can react to everyday price changes.

By utilizing a market simulator or business platform, you can check how the market changes monthly to cope with ongoing inflation.

Planning long-term price management decisions is no longer relevant in today’s market. Now is the time to be highly responsive with your pricing decisions whenever action is necessary.

4. Plan Options Beyond Pricing to Reduce Costs

The goal is to redesign products to reduce costs. This includes line optimization, inventory management, and even supply chain management.

For example, Brand A changed some of the ingredients of its product, which greatly reduced production costs. To ensure that the value of the product is maintained or increased, they conducted consumer research and analytics to see if customers noticed the difference.

If customers don’t notice the difference (or even have a positive reaction to the shift), that’s when you know you’ve succeeded in reducing costs.

5. Track Execution Relentlessly

By being vigilant and monitoring your brand’s performance across costs, sales margins, competitor reactions, and consumer reactions, you will be able to assess what actions you need to take next.

Data analytics can help support your brand by building business decision platforms that can help you navigate pricing inflation and feedback in a volatile market.

New price management decisions are based on looking at your business holistically so you don’t have to increase your product prices and risk losing your customers.

Conclusion

All in all, we’ve gone through the common causes of market volatility, which range from tariffs to tech weakness, in addition to the distinct types of market volatility such as forecast volatility and historical volatility.

Moving forward, we introduced the concept of the ADAPT framework and how it could be your key to survival in these dire times of market volatility.