On Friday, August 25, the USD to Egyptian Pound (EGP) exchange rate rose by 0.0385 points, reaching 30.8885 EGP/USD. (Trading Economics).

Moreover, according to Reuters, there will be a decline in the Egyptian pound value to 34.8 EGP per USD by the end of 2023, and according to Daily News, they expect to reach 35 EPG per USD.

Herein lies an exploration of the key challenges demanding your attention and the need for agility in today’s dynamic market.

A significant shift in consumer behavior:

As the value of the Egyptian pound declines, imported goods will become more expensive. Consequently, this can prompt Egyptians to adjust their spending patterns, prioritizing essential items while cutting back on discretionary purchases as they already receive the same disposable income with a declined value:

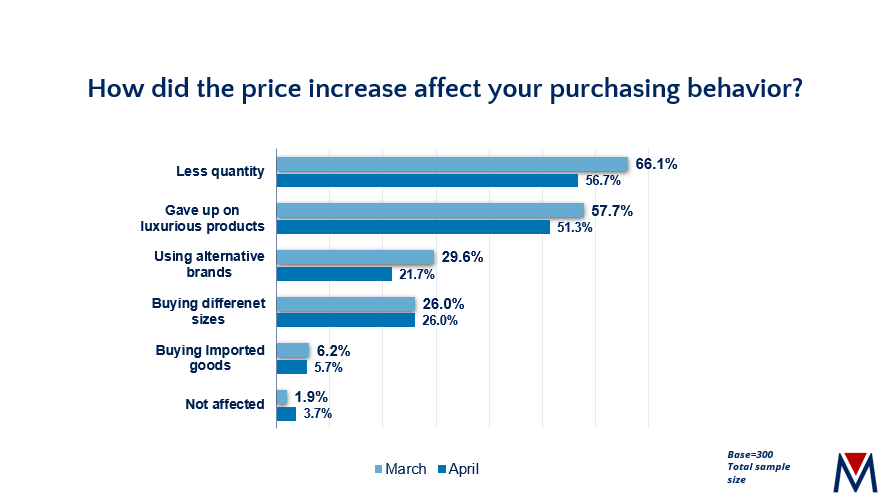

Our latest market pulse report, below showcases how the Egyptians’ purchasing behavior was affected after the devaluation of the Egyptian pound:

so, if you are interested to continue tracking consumer purchase behaviors for consumer goods products, sign up to be the first to receive our September 2023 Market Pulse tracking report

Demand Elasticity Insights:

Businesses will face diverse demand reactions from their customer base who became more price-sensitive after the Egyptian pound devaluation.

In consequence, many industries particularly the FMCGs/CPG industry will be subjected to high price sensitivity due to the large number of competitors which make it easy for the consumer to shift to the most affordable alternative. Hence, companies need to adapt pricing strategies to navigate the competitive landscape and uphold customer loyalty.

Supply chain disruption:

The increased cost of imported raw materials and components can lead to higher production expenses, potentially affecting product availability and consistency. As a result, this disruption can ripple through the supply chain, causing delays in production, distribution, and delivery, which in turn can impact customer satisfaction and overall business operations. In light of this, it’s prudent for businesses to proactively reassess their supply chain strategies, exploring avenues to mitigate the potential impact of increased production costs on product availability and pricing in the market.

Given the previously mentioned challenges, it is now imperative to align your decisions with agile market research insights:

Real-Time Consumer Insights:

Conductive quantitative studies to track the latest consumer behavior shifts allow you to identify emerging trends, concerns, and preferences influenced by the Egyptian pound devaluation.

Request a Zero Time™ proposal to get fast insights that can support your brand’s growth through market changes.

Dynamic Pricing Optimization:

With the power of data analytics, it can help you in Demand Forecasting, reaching pricing strategies that Maximize profits, and growing brand performance, which gives you a competitive edge.

Don’t miss out on transformative insights and request Marketeers’ Smart Pricing™ to unveil hidden growth opportunities during inflation.

In conclusion, when facing the challenges of the Egyptian pound devaluation, remember that analytics of your consumers’ insights are your indispensable way to navigate economic changes and consumer behaviors effectively.